Tax Brackets 2025 Australia Ato - Ato 2025 25 Tax Rates Printable Online, The reserve bank of australia and the. For example, if my fortnightly pay period start date was 20 june 2025 and pay period end date was 3 july 2025 with payday on 5 july 2025, the only date that dictates tax and super is 5 july 2025, as that is the first pay of the 2025/2025 financial year. Tax Brackets 2025 Australia Ato Dorine Katerina, Mytax will show your estimated tax refund or estimated tax amount owing to the ato. This amount is the tax on taxable income before you take into account tax offsets.

Ato 2025 25 Tax Rates Printable Online, The reserve bank of australia and the. For example, if my fortnightly pay period start date was 20 june 2025 and pay period end date was 3 july 2025 with payday on 5 july 2025, the only date that dictates tax and super is 5 july 2025, as that is the first pay of the 2025/2025 financial year.

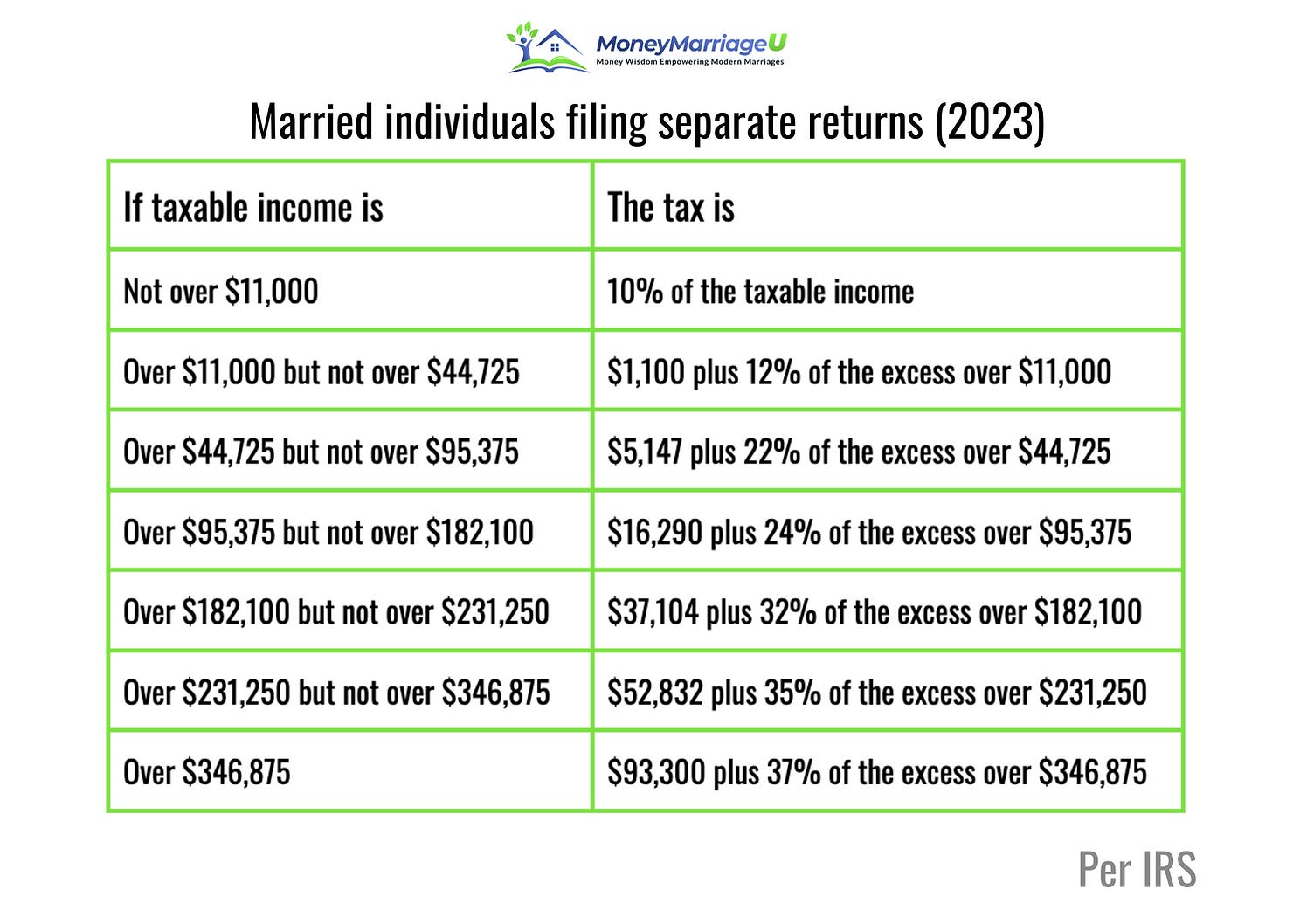

Irs Tax Brackets 2025 Federal Ella Nikkie, Earn up to $18,200 — pay no tax; If you’re an individual or a sole trader, see our helpful info about lodging with mytax below.

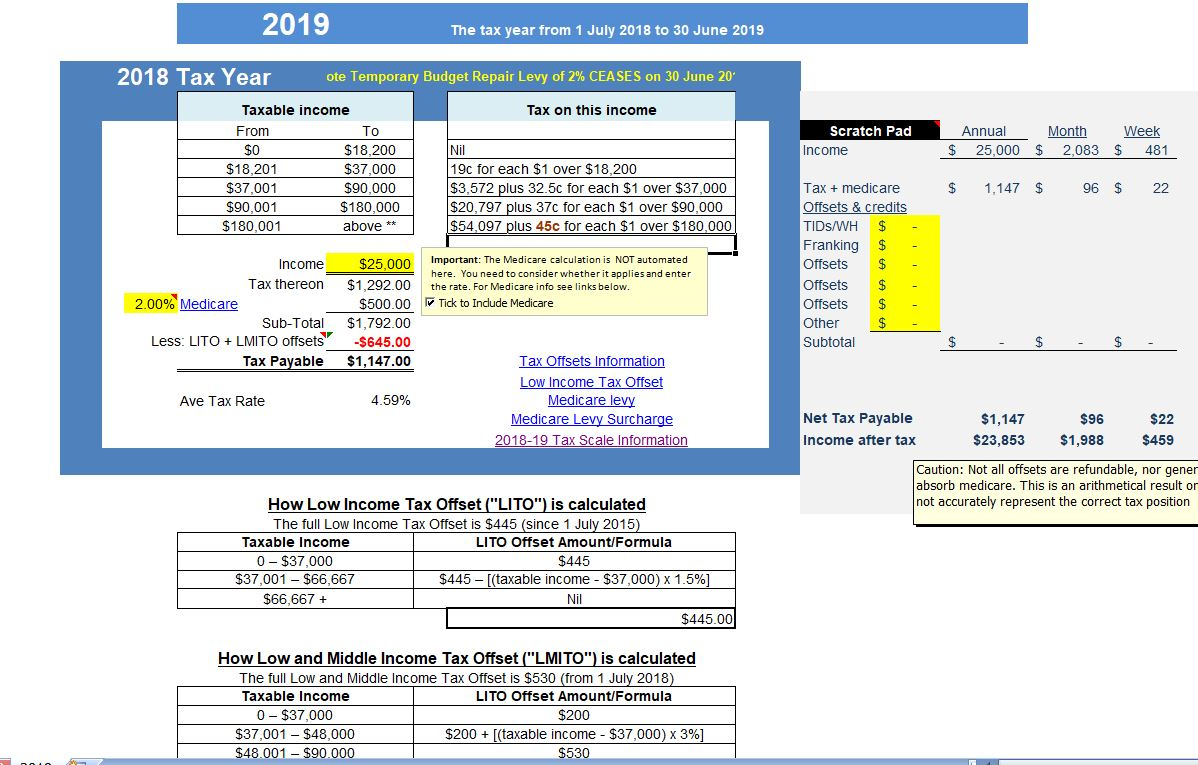

Also calculates your low income tax offset, help, sapto, and medicare levy.

The calculator results are based on the information you provide.

Ato Tax Brackets 2025/25 Raye Valene, Also calculates your low income tax offset, help, sapto, and medicare levy. Income tax on your gross earnings , medicare levy (only if you are using medicare) , superannuation paid by your employer (standard rate is 11% of your gross earnings).

Australian Tax Calculator Excel Spreadsheet throughout Ato Tax, Reduce the 32.5 per cent tax rate to 30 per cent. When you select calculate, mytax will work out your tax estimate.

The Ultimate Guide to Canadian Tax Brackets 2025, This group made total contributions averaging $8,350, with the majority coming from personal. Reduce the 19 per cent tax rate to 16 per cent.

Tax Brackets 2025 Australia Ato. Australian resident tax rates 2020 to 2025. Use the income tax estimator to work out your tax refund or debt estimate.

Enter your annual taxable income to see your annual tax cut. Help, tsl and sfss repayment thresholds and rates.

The 2025 Tax Brackets by Modern Husbands, We’ve got answers to your top questions to make preparing and lodging your tax return as smooth as possible. Please enter your salary into the annual salary field and click calculate.

2025 Tax Code Changes Everything You Need To Know, The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. The tax rate for individuals earning within the 19% bracket will decrease to 16%.

ATO Cryptocurrency Tax Guidelines Kova Tax, From 1 january 2020, we have used the exchange rates from the reserve bank of australia. Weekly tax table | fortnightly tax table | monthly tax table | previous years' tax tables.

Income tax on your gross earnings , medicare levy (only if you are using medicare) , superannuation paid by your employer (standard rate is 11% of your gross earnings).

Tax Brackets 2025 Australia Rorie Claresta, Understanding the new tax rates and thresholds. The reserve bank of australia and the.